Introduction to ORB Trading Strategy:

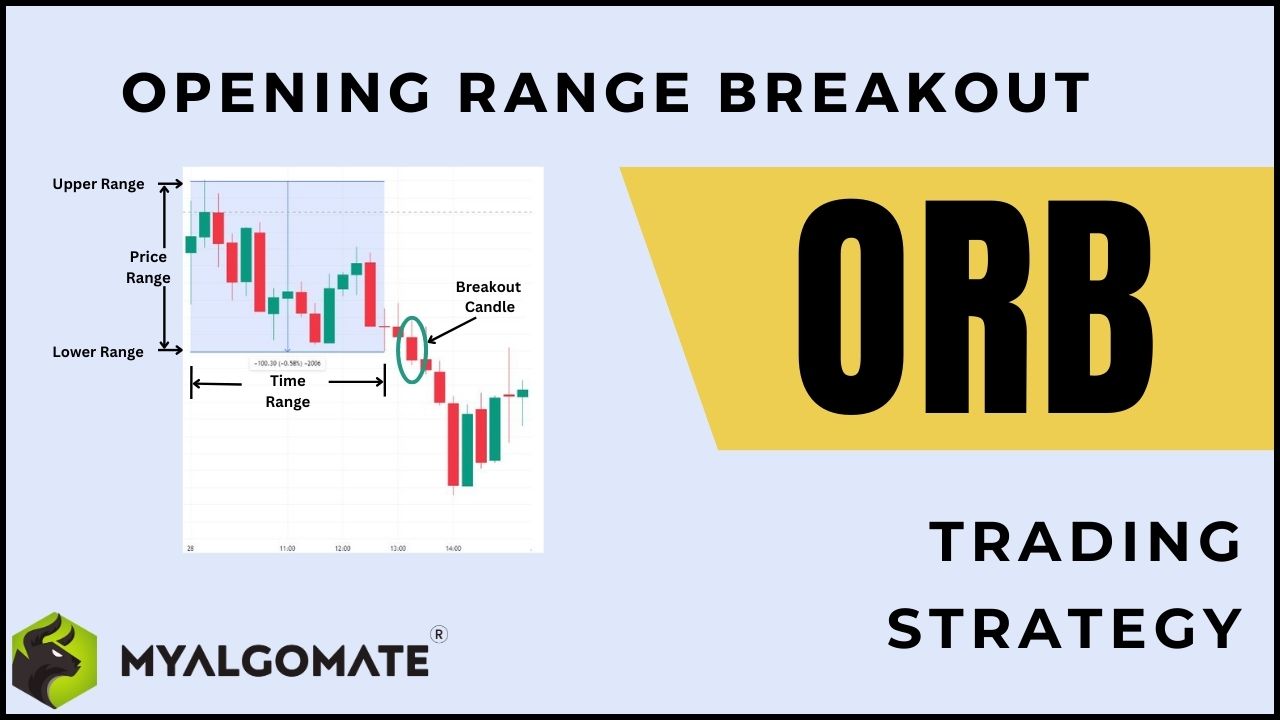

Opening Range Breakout (ORB) is a popular trading strategy used by traders in the Indian stock market. It involves monitoring the price movements of security within the first hour of trading to identify key levels of support and resistance and capitalize on subsequent price movements. In this article, we will discuss the basics of ORB trading strategy, its advantages, and a step-by-step guide to using it in the Indian stock market with examples and charts.

The automated version of this strategy is readily available at Myalgomate Marketplace as ORB | Opening Range Breakout | Automate ORB Strategy.

Understanding ORB Trading Strategy:

ORB trading strategy is based on the idea that the opening price range of a security is crucial in determining its future price movements. Traders typically monitor the first hour of trading to identify the highest and lowest price levels within that period. By using a percentage range, traders can calculate the upper and lower boundaries, which can help them identify potential trading opportunities.

Advantages of ORB Trading Strategy:

ORB trading strategy has several advantages that make it a popular choice among traders in the Indian stock market. Some of the benefits of ORB trading strategy are:

- Simple and easy to understand

- Works well in volatile markets

- Provides a clear entry and exit point

- Helps traders capitalize on the momentum

Step-by-Step Guide to ORB Trading Strategy in the Indian Stock Market:

Now let’s discuss how to use ORB trading strategy in the Indian stock market with a step-by-step guide and examples.

Step 1: Selecting the Security for Trading

Begin by choosing the specific security you wish to trade. For instance, let’s consider the Nifty 50 index for this example.

Step 2: Monitoring the First Hour of Trading in 15 min TimeFrame.

The next step involves closely observing the price movements of the chosen security within the initial hour of trading. To illustrate, let’s examine the first hour of trading on April 15, 2023. During this period, the Nifty 50 index fluctuates between a high of 17,209 and a low of 17,121. By establishing a range, we can identify the significant levels, using the low as support and the high as resistance.

Step 3: Identify the Breakout Level The third step is to identify the breakout level. Traders can use the upper boundary as the breakout level for long positions and the lower boundary as the breakout level for short positions.

Step 4: Enter the Trade Once the breakout level is identified, traders can enter the trade. For a long position, traders can enter the trade when the price breaks above the upper boundary, and for a short position, traders can enter the trade when the price breaks below the lower boundary.

In our example, the price breaks below the lower boundary at around 10:30 AM IST, as shown in the chart below:

Step 5: Set Stop-Loss and Take-Profit Levels Once the trade is entered, traders should set the stop-loss and take-profit levels to manage risk and maximize profits.

For this example, we can set our stop-loss at the upper boundary, 17,209, and target at 16,970 to 16,940, which is nearly a 1% profit target based on the 0.5% range(RR 1:2).

Step 6: Monitor the Trade After entering the trade, traders should monitor the price

After entering the trade, traders should monitor the price movements to determine when to exit the trade. In our example, the price reaches our take-profit level of 17,945 at around 3:25 AM IST, as shown in the chart below:

Step 7: Exit the Trade Once the take-profit level is reached, traders should exit the trade to lock in their profits. In this example, we can exit the trade at 17,945.

Risk Management in ORB Trading Strategy:

Risk management is crucial in any trading strategy, including ORB trading strategy. Traders should set stop-loss levels to limit their losses in case the trade goes against them. In addition, traders should avoid overtrading and stick to their trading plan to avoid emotional trading decisions.

How to Automate ORB Strategy

If you want to automate the ORB strategy, you can use algorithmic trading software. One such software is MyAlgoMate, which provides an ORB trading strategy for the Indian stock market.

MyAlgoMate’s ORB software is designed to automate the process of identifying opening range levels, entering trades based on breakout levels, and exiting trades at predetermined levels. With MyAlgoMate’s ORB strategy, you can set your own stop-loss and take-profit levels and choose the number of shares you want to trade.

Using algorithmic trading software like MyAlgoMate can provide several advantages, including:

- Emotionless Trading: By automating the trading process, you can remove emotions from the equation, which can lead to more disciplined and consistent trading decisions.

- Faster Execution: Algorithmic trading software can execute trades faster than humans, which can be crucial in fast-moving markets.

- Increased Efficiency: By automating the trading process, you can free up time to focus on other aspects of your trading strategy or to pursue other interests.

To learn more about MyAlgoMate’s ORB strategy, you can visit their website at https://www.myalgomate.com/product/orb-opening-range-breakout/.

In conclusion, using algorithmic trading software like MyAlgoMate can be an effective way to automate the ORB trading strategy in the Indian stock market. With its paper trading feature and customizable settings, MyAlgoMate provides traders with a powerful tool to test and implement their ORB strategy.

Disclaimer: All data and information provided in this article are for informational purposes only. Myalgomate® makes no representations as to the accuracy, completeness, correctness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.

2 Comments

Anika

November 5, 2024amazing post on Algo. thanks for the sharing

Pratibha

July 30, 2024Wonderful article.