What is algo trading?

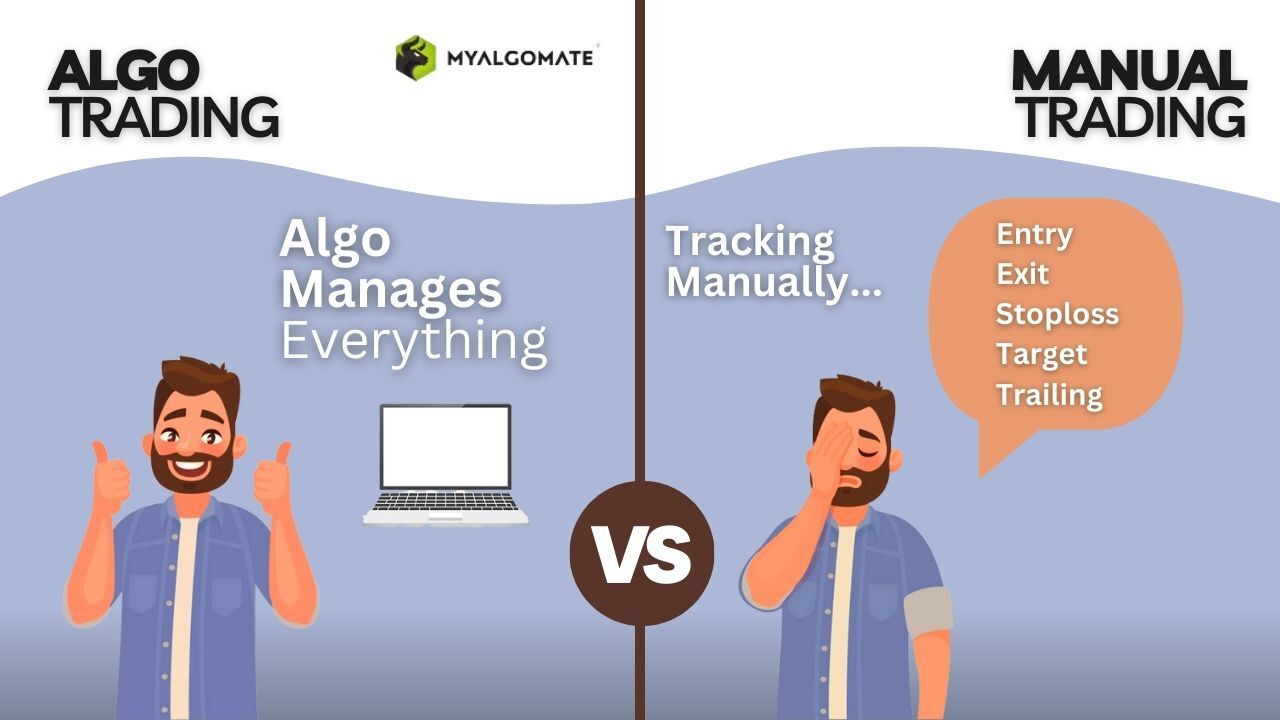

In this blog, we’ll explore algo trading vs manual trading, and their key differences, advantages, and disadvantages. By the end, you’ll know to determine which approach aligns with your trading strategy and resources.

In recent years, algorithmic trading (algo trading) has revolutionized the financial markets. While manual trading has been the traditional approach for decades, the rise of technology-driven trading has introduced a more precise, efficient, and automated method to investors and traders worldwide. So, how do these two methods stack up? Which one is better suited for your trading goals?

Check Out More details @ https://www.myalgomate.com/custom-algo-trading-strategy/

Ready to automate your strategy?

Submit the form and let’s start building your custom algo solution!

https://www.myalgomate.com/trading-software-developer/

Before submitting, check out our “FAQs” to answer common queries.

WhatsApp for any doubts/queries: https://wa.link/9ilrx0

Traditional Trading

Traditional trading is a method of buying and selling financial instruments such as stocks, bonds, and commodities based on market analysis, research, and experience. It involves taking into account considering as company earnings, news reports, and economic data, to determine the direction of the market. Traders use technical analysis, which involves studying charts and other data to identify patterns and trends in the market. They rely heavily on their intuition and experience to make informed decisions.

Advantages of Traditional Trading

Flexibility: Traditional trading offers traders a lot of flexibility in terms of strategy and decision-making. Traders can adjust their approach based on changing market conditions, which is not possible in algorithmic trading.

Intuition: Traditional trading allows traders to rely on their intuition and experience to make informed decisions.

Cost: Traditional trading can be less expensive than algorithmic trading, as it does not require specialized software and technical expertise.

Disadvantages of Traditional Trading

Time: Traditional trading requires a significant amount of time to analyze markets, track news, and execute trades manually. This can be a challenge for traders who have other commitments.

Emotions: Traditional trading involves emotions, which can cloud judgment and lead to poor decision-making.

Inaccuracy: Traditional trading can be less accurate and consistent than algorithmic trading, as it is based on human analysis and intuition, which can be biased and prone to errors.

Algorithmic Trading ( Automated Trading )

Algorithmic trading involves using computer programs to execute trades automatically based on pre-defined rules and criteria. These rules are often based on complex mathematical algorithms and historical data analysis. Algorithmic trading is becoming increasingly popular among traders, particularly institutional investors and hedge funds, who have access to sophisticated software and technical expertise.

Advantages of Algo Trading vs Manual Trading

Time: Algorithmic trading can be done automatically and requires less time and attention than traditional trading.

Accuracy: Algorithmic trading is based on mathematical models and historical data analysis, which can make it more accurate and consistent than traditional trading.

Risk Management: Algorithmic trading can help minimize risk by automating the trading process and using sophisticated risk management techniques.

Disadvantages of Algo Trading vs Manual Trading

Cost: Algorithmic trading can be more expensive than traditional trading, as it requires specialized software and technical expertise.

Inflexibility: Algorithmic trading is based on pre-defined rules and criteria, which can limit flexibility in strategy and decision-making.

Failures: Algorithms can fail or produce unexpected results, which can lead to significant losses.

Examples of Algo Trading Strategies vs Manual Trading Strategies

Trend Following: This strategy involves identifying trends in the market and buying or selling assets based on those trends. For example, if a stock has been rising steadily, the algorithm might buy the stock with the expectation that the trend will continue.

Mean Reversion: This strategy involves identifying assets that are overvalued or undervalued relative to their historical prices. The algorithm might buy assets that are undervalued and sell assets that are overvalued, with the expectation that prices will eventually revert to their mean.

Arbitrage: This strategy involves exploiting price discrepancies between different markets or assets. The algorithm might buy an asset in one market where it is undervalued and sell it in another market where it is overvalued, with the expectation of profiting from the price difference.

High-Frequency Trading: This strategy involves executing trades at lightning-fast speeds to take advantage of small price fluctuations in the market. The algorithms used for this strategy are highly sophisticated and require specialized software and hardware.

Which Trading Method is Right for You?

Deciding on which trading method is right for you depends on several factors, such as your experience, resources, and risk tolerance. If you are a beginner trader, traditional trading may be a better option as it allows you to learn and understand the market dynamics better. On the other hand, if you have access to specialized software and technical expertise, algorithmic trading may be a viable option.

It is essential to remember that both trading methods have their advantages and disadvantages. It is up to you to weigh the pros and cons and decide which method aligns with your trading goals and style. Additionally, it is essential to have a solid understanding of the market and financial instruments you are trading to make informed decisions.

Conclusion

In conclusion, both algorithmic trading and traditional trading have their merits and drawbacks. Traditional trading provides flexibility and allows traders to rely on their intuition and experience to make informed decisions. Algorithmic trading, on the other hand, is more accurate and consistent, requires less time and attention, and can help minimize risk. Ultimately, choosing the right trading method comes down to your trading goals, experience, and resources. By understanding the differences between the two methods, you can make an informed decision and achieve success in the financial markets.

What’s Next?

Check out our other blogs on Algo Trading: Top 10 Intraday Trading Principles, What is Algorithmic Trading? , Things to Know Before Starting Algorithmic Trading and Learn Algorithmic Trading: A Step By Step Guide

Disclaimer: All data and information provided in this article are for informational purposes only. Myalgomate® makes no representations as to the accuracy, completeness, correctness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.