Freak Trade

Introduction

Freak Trade – Before learning about the freak trade, first, you need to know what NSE and BSE are? National Stock Exchange (NSE) is the biggest stock exchange marketplace of India, along with a front runner in the introduction of the fully automated, electronic trading system across the country. Nifty50 is NSE’s benchmark index. In contrast, the Bombay Stock Exchange (BSE) is the oldest stock exchange marketplace, not just for India but Asia as well, which offers high-speed trading to its customers. Sensex is BSE’s benchmark index. You can get more information about NSE & BSE from their websites. So, now let’s move forward with the freak trade.

What Is Freak Trade?

A trade is considered a freak trade generally when a large company or trader makes an erroneous trade (incorrect), but this trade is so wrong and massive that it often affects that stock at large (the same applies for indices). For example, in the Indian stock market, there exists the Nifty index.

List of Freak Trade:

Do you remember? On Friday, 20th August 2021, options traders faced unusual price movement in the NIFTY contract. Nifty 16450 CE August expiry spiked to ₹803.05 from only ₹100. But do you know the reason for this price break? This happened because of a liquidity issue. This spike may have impacted a lot of traders. This is a live example of freak trade.

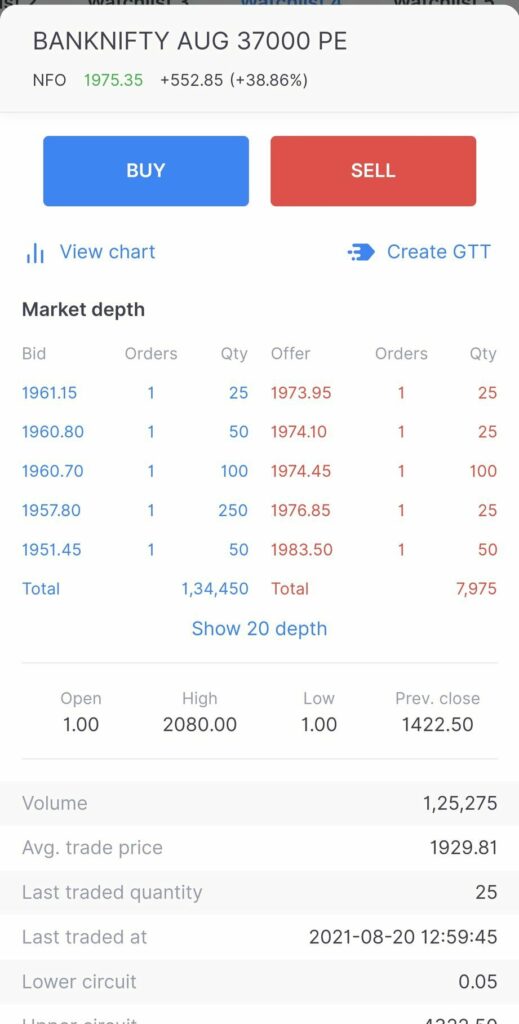

- On 20th Aug 2021, Bank Nifty 3700 PE Surged to 2080.

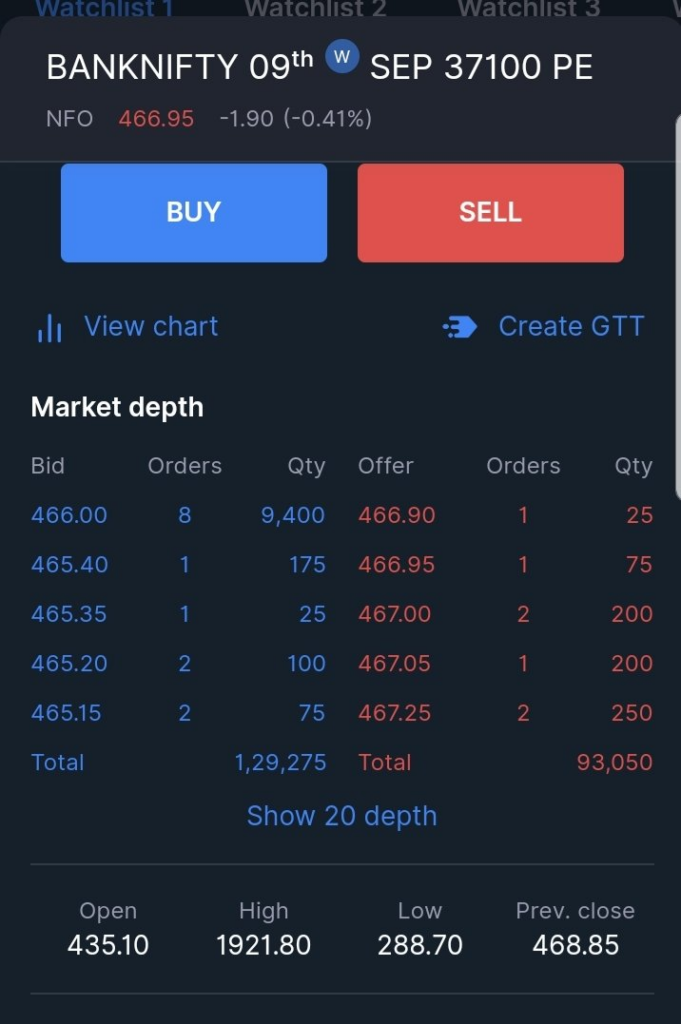

- On 3rd Sept 2021, Bank Nifty 37100 PE surged to 1921.

How Do Freak Trades Happen?

Some of the reasons for this kind of trades are as follows;

- Fat Finger Traders

- Algos placing continuous orders because of errors in the system using Algo Trading Software

- Possibility of stop-loss market orders triggering at a certain point

- Due to an imbalance in demand and supply price spike

What Is A Fat Finger Trade?

Suppose a trader wants to buy 600 quantities of Nifty 16450 CE but types in 6000 quantities by mistake. This is simply a fat finger trade. To avoid fat finger trades, the exchanges have a quantity freeze rule, which regulates the flow of orders within a specified quantity to prevent such numbering errors.

W.e.f. August 2, 2021 exchange has defined single order freeze quantity for Nifty, Bank Nifty, Finnifty as 2800, 1200, and 2800 respectively. NSE automatically cancels any order size above this limit to safeguard the trader and protect market activity. There may be multiple reasons for the price spike on 20th August 2021, in Nifty 16450 CE, but one of the reasons is the discontinuation of the Trade Execution Range (TER).

What Is Trade Execution Range (TER)?

Trade Execution Range (TER) is the price range set by the stock exchanges as a risk management tool to ensure that no order gets executed beyond a specific price range. For example, if NIFTY 16450 CE is trading at ₹100, and the TER is 40%, then the lower price range will be defined as ₹60 and the upper price range as ₹140. No order will get executed beyond this limit.

If the price hits the upper limit or the lower limit, there will be a trading freeze for a couple of seconds or minutes to cool off the price before announcing a new TER to start the trading, just like an upper circuit or lower circuit. Indeed, this is the best protocol to prevent freak trades.

On 16th August 2021, NSE removed the TER mechanism for all contracts traded in the Equity Derivative Segment.

How Can We Protect Our Portfolio From Freak Trades?

-

Use Higher Limit Order Than Market Order

When buying or selling any script or derivatives contract, use limit orders and place an upper limit price than the LTP or Touchline. E.g. If you want to buy Nifty 16450 CE, which has LTP at ₹99,

- Place limit orders at ₹99 (same as LTP).

- Check the best seller in case of immediate buying.

There may be best sellers at ₹100 and best and Best Buyers at ₹99 in market depth. Place the limit order at ₹100, so your order gets filled at 100 or better average price. Sometimes prices may move fast, so people buy at Market price. Instead of market price, place the order at 3-4% higher than the best sellers. If the best-seller is at ₹100, place buy with a limit order at ₹103. Now your order will be executed at the best price. Sometimes there will be a vast difference between best-sellers and best buyers, strictly avoid those scripts to prevent freak trade.

-

Use Stop Loss Limit (SL-L) Than Stop Loss Market (SL-M) Order

When you place stop-loss orders, use the SL-L order type, where you have to give trigger price and limit price. Once your order gets triggered, your order will be converted as a limit order. However, we all know stop loss is essential for traders as well as speculators. So using SL is necessary.

Disclaimer: All data and information provided in this article are for informational purposes only. Myalgomate™ makes no representations as to accuracy, completeness, correctness, suitability, or validity of any information in this article and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. All information is provided on an as-is basis.