Available Fields: STRIKE, LTP, OI, VOLUME, INTRINSIC, PREMIUM, DELTA

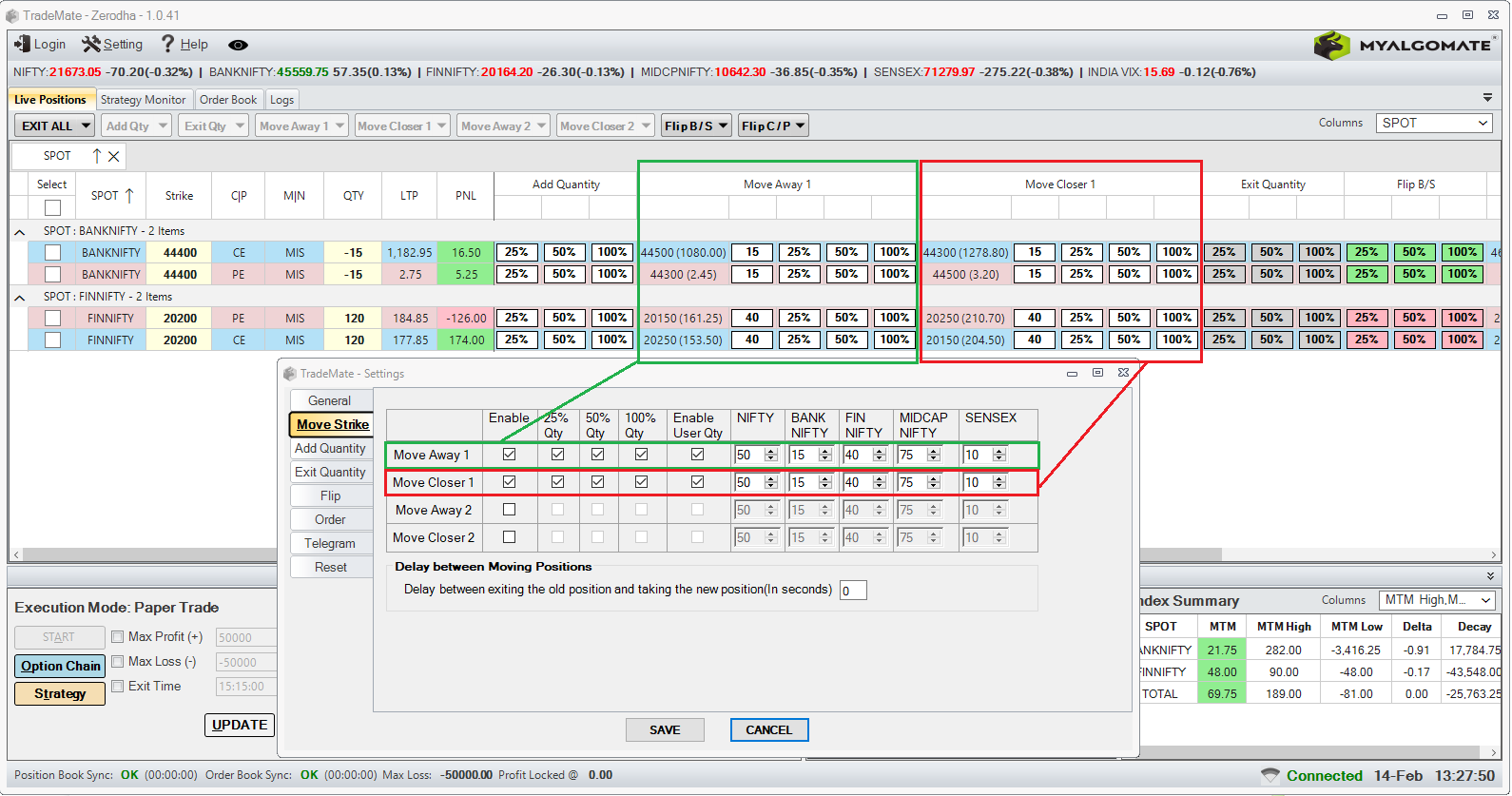

The delay between exiting the old position and taking the new position(In seconds)

The delay (in seconds) between exiting an individual option position and taking a new one to avoid rejection due to margin constraints.

If you maintain an additional margin then you can keep 0.

Enable automatic flipping of buy positions to sell positions with the flip button.

If you have a buy position of 100 quantities in any option contract, it will exit the buy position and sell another 100 quantities to flip the position.

Enable automatic conversion of buy positions from Call Options (CE) to Put Options (PE) and vice versa with the click of the flip button.

If you have a buy position of 100 quantity in a CE, it will exit the same position and buy the PE with the same quantity and strike.

The delay between flipping sell positions and buy positions :

It will flip sell positions first.

The delay (in seconds) between the start of flipping of sell positions and flipping buy positions to avoid rejection due to margin constraints.

If you maintain an additional margin then you can keep 0.

Individual Option Position Flip Delay (secs) :

The delay (in seconds) between exiting an individual option position and taking a new one to avoid rejection due to margin constraints.

If you maintain an additional margin then you can keep 0.

For limit orders,

Setting the Limit Price: You have the option to set the limit price using a Limit buffer %/Pts. For instance, if you set the limit buffer to 2 points, and the Last Traded Price (LTP) is 100, it will place a sell order with a price of 98.

Order Execution Timeout: In case the order doesn’t get executed within the specified time frame, you can choose from the following options:

Choose the relevant index from the provided dropdown list: Nifty | Bank Nifty | Fin Nifty | Midcap Nifty | Sensex | Bankex

Utilize a single button to switch the entry type – from Buy to Sell or Sell to Buy.

You can configure the interval for checking the max profit-based exit and max loss-based exit individually for both. Below are the different modes that you can set.

You can configure the “Exit modes” individually for both “Max Profit” and “max Loss”. Below are the different modes that you can set.

You can configure the “Positions to exit” individually for “Max Profit”, “Max Loss”, and “Time-Based Exit”. Below are the different modes that you can set.

The following modes are available for the “Protect Profit” feature.

Rajesh Kapoor –

I switched from Tradeflow Algo to Trademate, and the difference is huge! Trademate gives more control over discretionary trades, and I’ve been able to increase my profits by adjusting trades on the fly. Perfect blend of manual and algo trading!

Nilesh –

I have been using this product since a long time and trade directly from option chain is a great feature.

Swapnil Patel –

This is good product and a best TradeFlow Algo Software Alternative. Best in price and features

pravin shekhar (verified owner) –

I have been using this tool for some time. Software is quite useful in placing strangle and straddle orders and managing them through one click. Execution is very good without lags. Their customer support is very approachable, considerate and open to feedback. They have lot of upcoming features in the software which is very exciting,looking forward, thanks

J D (@JD_optiontrader) (verified owner) –

I’ve been using TradeMate for the past month, and I must say, I’m thoroughly impressed. The trade execution is top-notch, with features like moving away and moving close, along with other risk management tools that are simply superb. Moreover, the customer support is just amazing. Their team is always approachable and willing to help even after the purchase of the product.

I recently requested them to add a feature that would better suit my trading style, and they delivered it exactly as I had hoped.

Ashwini Kumar (verified owner) –

Best tool for hassle free trading on 0DTE, Execution is top notch…